Tuesday, May 27, 2008

Not a Slippery Slope

How does the transition to monogamy occur? The authors first make the case that the source of male income is itself a determinant of polygyny. When male income and wealth are derived from non-labor sources such as land and natural resources or via corruption as they frequently are in less developed economies, rich males have a comparative advantage in producing large quantities of children. As industrialization proceeds, the return to land and natural resources declines and the returns to human capital rise. A key characteristic of the development process is that women are allowed to become more productive. As female inequality in human capital increases, males and females with high levels of human capital begin to enjoy a comparative advantage in producing quality (educated) children. In addition, as female inequality in human capital increases, women gain the upper hand in determining the terms of the marriage contract and are able to extract (enforce) a monogamous, rather than polygynous contract, from males.

My interpretation of the author's model is that the slippery slope argument against same-sex marriage is a straw man, unlikely to lead the way to polygamous marriage in the future.

Tuesday, April 22, 2008

Unintended consequences of the death penalty for child rapists

Thursday, April 10, 2008

Wednesday, April 2, 2008

Food for Thought

Thursday, March 27, 2008

Words of Wisdom

"If the government underwrites all the risks, call it socialism. If it underwrites only the failures, call it foolishness."

Monday, March 24, 2008

Behavioral Economics for Business People

people are often reluctant to sell a stock that has performed poorly until it is back to the price it was originally bought at. A consequence of loss aversion is that these same people become risk averse for gains, but risk-takers for losses.

I was reading V.S. Naipaul's A Bend in the River when I came across this passage that helps fix the idea. The narrator is in the process of buying a business from an owner wishing to sell and receives this advice from the owner of the business.

"You must always know when to pull out. A businessman isn't a mathematician. Remember that. Never become hypnotized by the beauty of numbers. A businessman is someone who buys at ten and is happy to get out at twelve. The other kind of man buys at ten, sees it rise to eighteen and does nothing. He is waiting for it to get to twenty. The beauty of numbers. When it drops to ten again he waits for it to get back to eighteen. When it drops to two he waits for it to get back to ten. Well, it gets back there. But he has wasted a quarter of his life. And all he's got out of his money is a little mathematical excitement."

Thursday, March 13, 2008

Savers of the World, Unite!

But it is likely that the Fed is sowing the seeds of further inflation. Pumping liquidity into the system to fix what is primarily a sector problem (excess supply and weak demand in the housing sector) never has made sense, and still doesn't. The Fed tried that in the 1970s when oil first zoomed in price and all we got was stagflation. It is beginning to look as if we may have a repeat of that era. Is it any wonder that the price of oil has gotten so high today (over $110) as the dollar has slumped to record lows?

There is no doubt that the Fed's current policies are anathema to anyone in our economy with savings. The combination of low interest rates (banks seem to be playing a game of how low can you go with the interest rates that they pay) and accelerating price increases means negative returns for anyone with money in the bank. In addition, the faltering stock market eats away at people's retirement accounts, many of whom are Baby Boomers who might like to retire soon. Where's the incentive to save in such an environment?

It might be argued that savers need to tolerate lower returns for a while for the greater good: improving the economy's performance. I could accept that argument if the Fed were actually trying to do that; but its current mix of policies seem unlikely to improve anything.

Wednesday, March 12, 2008

Rams for Official Missouri NFL Team!

Monday, February 25, 2008

Two Big Numbers

To say that the US is spending more than it produces is to state the obvious. To say that the US needs to reign in its spending and increase its savings is also to state the obvious. Yet, a look at current monetary and fiscal policies makes one wonder what the government and the Fed are thinking. The Fed is feverishly lowering interest rates to stimulate spending while the Federal Government has already passed a tax rebate to help people spend more as spring approaches. Of course, the reason for these moves is to presumably forestall a recession or help us to get out of one that we may already be in.

Given that consumers will not get checks until May and given that Fed policy takes 6-8 months to have any real effect, the question has to be: why are we doing this? Why is the Federal Government spending money it doesn't have and why is the Fed lowering interest rates only to set us up for the next bubble that it will create (recall the tech stock boom of the late 1990s and the housing boom most recently-both Fed caused)? The recession/slow growth will end by June/July at the latest and the economy will start to recover, regardless of the stimulus packages that the government and the Fed have concocted. Are we going back to the days of stop/start economic policies that we experienced in the 1970s/1980s? We can hope we are not, but it is beginning to look as if this is the case.

Wednesday, February 20, 2008

Possible Causes of the Industrial Revolution

Clark examines the main economic growth theories and finds them all insufficient as explanations for growth. Instead, Clark argues that there were four main drivers of the Industrial Revolution that occurred over centuries. First, interest rates declined because individuals became more patient and willing to defer gratification. In an interesting section, Clark gives evidence that forager/hunter societies have very high rates of time preference (they strongly prefer current consumption to future consumption). For example, the Yanomamo of Brazil, have such a high rate of time preference that they cut the branches off berry bushes to make picking easier, even though it reduces future harvests and even kills the bush. The decline in interest rates allowed greater accumulation of capital which helped fuel growth. Second, economic growth occurred because of greater willingness to work more. People in forager societies lived at the subsistence level but worked little; on average the male Yanomamo worked between three and six hours a day, while male laborers in England worked between eight and nine hours per day, but also existed at the subsistence level. However, the longer work hours became a cultural norm and helped enhance efficiency as the world went through the demographic transition to lower population growth. Third, "literacy and numeracy went from a rarity to the norm." Numeric skills were needed to facilitate the use of money as a medium of exchange, rather than barter, and ultimately allowed technological innovation to spread. Finally, there was a decline in interpersonal violence. While Clark glosses over this driver of growth, I would argue that the decline in interpersonal violence gave rise to greater trust between individuals. Without trust, voluntary trade between strangers is more difficult resulting in a loss of the gains from specialization according to comparative advantage.

Clark provides evidence on a wide range of economic and social indicators between various hunter/gatherer societies and more industrial societies to build his case. He looks at height, fertility rates, calorie consumption, work hours, transportation costs, population, profit rates, interest rates, land rents, and wages. Clark's overall theme seems to suggest that the industrial revolution occurred in England and Europe because of cultural changes, rather than institutional changes, such as greater reliance on private property rights and markets and limited government.

Friday, February 8, 2008

Presidents, Economic Growth, and CO2 Emissions' Growth

Since 1960, Democratic presidents have achieved higher average annual rates of real GDP growth than Republic Presidents. As concern about global warming mounts among scientists, policy-makers, and citizens, how do the different presidents fare on CO2 emissions? Reading from left to right we have Bush II, Bush I, Nixon/Ford, Carter, Reagan, Clinton, and JFK/LBJ. Higher growth rates of real GDP per capita are strongly correlated (r=0.72) with higher growth rates of emissions. Of course, correlation does not prove causation, but it should give pause for concern about the difficult tradeoffs society faces concerning future emissions and economic growth.

The Barbarian Invasions

Tuesday, February 5, 2008

Pretense of Knowledge in Financial Economics

The over reliance on artificial mathematical precision may also be more apparent in financial economics. Over the last decade many Wall Street investment banking firms relied on PhDs in statistical physics to quantify risk in securitized lending such as the sub-prime secondary market despite their having little institutional understanding of how these markets operate. Clearly, many of the models perpetuated by Wall Street were wrong but you can afford to be wrong if you can rely on the Bernanke put.

Thursday, January 31, 2008

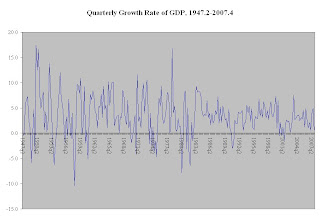

Decline in GDP Volatility

Although the Fed has not targeted money aggregates for some time, several explanations have been offered for the decline in the volatility of GDP since the early 1980s. These include financial deregulation/innovation, improvements in supply chain management that have substantially reduced inventory backlogs associated with economic down turns, inflation booms that have been tempered by global competition and the absence of major macroeconomic shocks like an OPEC oil embargo. Although greater Fed transparency, beginning with the publication of Federal Open Market Committee meeting minutes in 1994 reduced uncertainty regarding Fed policy, this has had more of an impact on volatility in financial markets rather than volatility in the real economy.

FED Policy has reduced GDP volatility

Wednesday, January 30, 2008

Fed Policy and a Pretense of Knowledge

If economics is “real science” a notion that Nassim Taleb bestselling author of the Black Swan disputes, then one might expect some consistency among economic scientists in regard to fundamental principle. The fundamental principle of capitalism is the self-correcting nature of market systems. Yet, the majority of the economics profession is not yet convinced that markets work. To me, this is analogous to saying that a majority of physicists disagree with gravity.

It is little wonder that practitioners of the dismal science have largely failed as popular champions of spontaneous order. Constructivist macroeconomists at the Federal Reserve and elsewhere continue to perpetuate the myth of discretionary fiscal and monetary stabilization policy despite an empirical record of failure documented in Friedman and Schwartz’s (1963) Monetary History of the United States. Friedman argued against discretionary stabilization policy because it presupposes accurate forecasts and economic science is not sufficiently advanced to satisfy this requirement. Mesmerized by artificial mathematical precision and what Hayek labeled a “pretense of knowledge,” a large segment of the economics profession is loath to admit that their discipline is too primitive to successfully implement discretionary stabilization policy.

Friday, January 25, 2008

Greenhouse Gas Emissions and the T3 Tax

The IPCC (Intergovernmental Panel on Climate Change) presents evidence from scientists in many fields that burning coal and oil has increased CO2 emissions by 70% from 1970 to 2004. Other emissions, including methane (CH4) and nitrous oxides (NO2), have also increased. Such GHG (greenhouse gas) emissions are thought to be a source of global warming. Adding a sense of urgency, the IPCC reports that eleven of the last twelve years have been the warmest on record since 1850, when widespread recording of temperatures began.

According to IPCC scientist and economist Ross McKitrick, "climate change models predict that, if greenhouse gases are driving climate change, there will be a unique fingerprint in the form of a strong warming trend in the tropical troposphere, the region of the atmosphere up to

Wednesday, January 23, 2008

Did the Fed Panic?

The "r" word is getting tossed around a lot lately, but it is interesting that we do not even know yet if GDP growth has turned negative (the preliminary figures for GDP for the fourth quarter of 2007 will not be released until next Wednesday, January 30). One Federal Reserve Bank President, William Poole of the St. Louis Fed, voted against the emergency rate cut saying that he did not think conditions warranted it. I have to agree with him-to me, the Fed's move seems like it has lost control and is responding to events rather than anticipating them. And is the Fed just setting us up for the next bubble by again deciding to flood the markets with liquidity?

Friday, January 18, 2008

Summer Opportunity for Students

students interested in environmental economics. The information on how to apply is here.

Hayek and Hero Teachers

Friedrich Hayek argued that social constructs such as markets, language, the legal system, etc., were evolved processes derived from collective experience. While Hayek accepted that there were experts who harbored knowledge in specialized fields, he believed that the most important knowledge in society was widely dispersed among the population. Accordingly, no small group of central planners could ever hope to duplicate the hundreds of millions of decisions necessary to produce a top-down economic outcome superior to the one produced by a bottom-up market system.

Rather than the enlightened advice of a few elites, Hayek believed that a functioning society depended more on the distilled experience of the many which could be codified into rules of behavior. This collective knowledge is transmitted socially in largely inarticulate form leading to a “spontaneous order.” Competition among institutions results in the survival of cultural traits and behaviors that “work” even if the winners or losers never fully understand why they worked. To quote Hayek, there is “more ‘intelligence’ incorporated in the system of rules of conduct than in man’s thoughts about his surroundings.”

The inferior outcome resulting from intervention in evolved processes is not confined to market systems. For example, some educators and the media have perpetuated the myth of an idealistic hero teacher who enters an inner-city school and is shocked by the educational inadequacies. The hero teacher perseveres and by innovative teaching methods, personal sacrifice and a lot of heart inspires the students to win the state championship in music, mathematics, etc. We have all seen the movie but there is only one problem; to quote Tabarrock in Marginal Revolution “hero teachers are not replicable.” If hero teachers are required to save education then our children are in deep trouble. Fortunately, studies have shown there is a replicable method of teaching based on evolved process that does not require the instructor to be a hero. The method is known as Direct Instruction and employs a carefully constructed teaching script based on rules that rely more on perspiration than inspiration. Predictably, education elites vilify the Direct Instruction method as “rote learning” and instead advocate that every teacher blaze their own educational trail and aspire to hero status.

The myth of the hero teacher is also prevalent in higher education, particularly among universities with cultures that are still mired in their "teachers college" past. T he Direct Instruction script in higher education mean teaching a course that reflects the evolved body of knowledge within the professor's discipline. For students who want to be charmed, entertained or inspired it is cheaper to rent a movie, read a book or go to church.

Thursday, January 17, 2008

SteriodMania

One columnist, Mike Celzic, indicates that the true losers are the minor leaguers who never made it to the majors because of the use of illegal drugs by major league baseball players. Celzic reports of at least one minor leaguer (Rich Harman) who is contemplating a suit against major league baseball claiming that its failure to stem the usage of performance-enhancing drugs led to he and many other minor leaguers having their paths to the big leagues blocked, presumably because many players who might otherwise have retired or would not have been successful in the big leagues without the illegal drugs were able to stay on.

This is probably a long shot of a lawsuit and legal scholars are divided on whether such a suit would have merit in a court of law. The claimant would have a pretty huge burden of proof to show that he was harmed. But the efficiency aspects of it are intriguing. If baseball players who used performance-enhancing drugs could be sued by minor leaguers claiming that their path to the big leagues was blocked by such cheats, this might be a more effective way to lead to the desired result, which, of course, is not to use the drugs. One successful suit for millions of dollars in damages might be enough to give correct incentives to all big league players to stay clean.