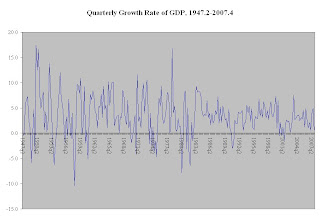

Although the Fed has not targeted money aggregates for some time, several explanations have been offered for the decline in the volatility of GDP since the early 1980s. These include financial deregulation/innovation, improvements in supply chain management that have substantially reduced inventory backlogs associated with economic down turns, inflation booms that have been tempered by global competition and the absence of major macroeconomic shocks like an OPEC oil embargo. Although greater Fed transparency, beginning with the publication of Federal Open Market Committee meeting minutes in 1994 reduced uncertainty regarding Fed policy, this has had more of an impact on volatility in financial markets rather than volatility in the real economy.

Thursday, January 31, 2008

FED Policy has reduced GDP volatility

Wednesday, January 30, 2008

Fed Policy and a Pretense of Knowledge

If economics is “real science” a notion that Nassim Taleb bestselling author of the Black Swan disputes, then one might expect some consistency among economic scientists in regard to fundamental principle. The fundamental principle of capitalism is the self-correcting nature of market systems. Yet, the majority of the economics profession is not yet convinced that markets work. To me, this is analogous to saying that a majority of physicists disagree with gravity.

It is little wonder that practitioners of the dismal science have largely failed as popular champions of spontaneous order. Constructivist macroeconomists at the Federal Reserve and elsewhere continue to perpetuate the myth of discretionary fiscal and monetary stabilization policy despite an empirical record of failure documented in Friedman and Schwartz’s (1963) Monetary History of the United States. Friedman argued against discretionary stabilization policy because it presupposes accurate forecasts and economic science is not sufficiently advanced to satisfy this requirement. Mesmerized by artificial mathematical precision and what Hayek labeled a “pretense of knowledge,” a large segment of the economics profession is loath to admit that their discipline is too primitive to successfully implement discretionary stabilization policy.

Friday, January 25, 2008

Greenhouse Gas Emissions and the T3 Tax

The IPCC (Intergovernmental Panel on Climate Change) presents evidence from scientists in many fields that burning coal and oil has increased CO2 emissions by 70% from 1970 to 2004. Other emissions, including methane (CH4) and nitrous oxides (NO2), have also increased. Such GHG (greenhouse gas) emissions are thought to be a source of global warming. Adding a sense of urgency, the IPCC reports that eleven of the last twelve years have been the warmest on record since 1850, when widespread recording of temperatures began.

According to IPCC scientist and economist Ross McKitrick, "climate change models predict that, if greenhouse gases are driving climate change, there will be a unique fingerprint in the form of a strong warming trend in the tropical troposphere, the region of the atmosphere up to

Wednesday, January 23, 2008

Did the Fed Panic?

The "r" word is getting tossed around a lot lately, but it is interesting that we do not even know yet if GDP growth has turned negative (the preliminary figures for GDP for the fourth quarter of 2007 will not be released until next Wednesday, January 30). One Federal Reserve Bank President, William Poole of the St. Louis Fed, voted against the emergency rate cut saying that he did not think conditions warranted it. I have to agree with him-to me, the Fed's move seems like it has lost control and is responding to events rather than anticipating them. And is the Fed just setting us up for the next bubble by again deciding to flood the markets with liquidity?

Friday, January 18, 2008

Summer Opportunity for Students

students interested in environmental economics. The information on how to apply is here.

Hayek and Hero Teachers

Friedrich Hayek argued that social constructs such as markets, language, the legal system, etc., were evolved processes derived from collective experience. While Hayek accepted that there were experts who harbored knowledge in specialized fields, he believed that the most important knowledge in society was widely dispersed among the population. Accordingly, no small group of central planners could ever hope to duplicate the hundreds of millions of decisions necessary to produce a top-down economic outcome superior to the one produced by a bottom-up market system.

Rather than the enlightened advice of a few elites, Hayek believed that a functioning society depended more on the distilled experience of the many which could be codified into rules of behavior. This collective knowledge is transmitted socially in largely inarticulate form leading to a “spontaneous order.” Competition among institutions results in the survival of cultural traits and behaviors that “work” even if the winners or losers never fully understand why they worked. To quote Hayek, there is “more ‘intelligence’ incorporated in the system of rules of conduct than in man’s thoughts about his surroundings.”

The inferior outcome resulting from intervention in evolved processes is not confined to market systems. For example, some educators and the media have perpetuated the myth of an idealistic hero teacher who enters an inner-city school and is shocked by the educational inadequacies. The hero teacher perseveres and by innovative teaching methods, personal sacrifice and a lot of heart inspires the students to win the state championship in music, mathematics, etc. We have all seen the movie but there is only one problem; to quote Tabarrock in Marginal Revolution “hero teachers are not replicable.” If hero teachers are required to save education then our children are in deep trouble. Fortunately, studies have shown there is a replicable method of teaching based on evolved process that does not require the instructor to be a hero. The method is known as Direct Instruction and employs a carefully constructed teaching script based on rules that rely more on perspiration than inspiration. Predictably, education elites vilify the Direct Instruction method as “rote learning” and instead advocate that every teacher blaze their own educational trail and aspire to hero status.

The myth of the hero teacher is also prevalent in higher education, particularly among universities with cultures that are still mired in their "teachers college" past. T he Direct Instruction script in higher education mean teaching a course that reflects the evolved body of knowledge within the professor's discipline. For students who want to be charmed, entertained or inspired it is cheaper to rent a movie, read a book or go to church.

Thursday, January 17, 2008

SteriodMania

One columnist, Mike Celzic, indicates that the true losers are the minor leaguers who never made it to the majors because of the use of illegal drugs by major league baseball players. Celzic reports of at least one minor leaguer (Rich Harman) who is contemplating a suit against major league baseball claiming that its failure to stem the usage of performance-enhancing drugs led to he and many other minor leaguers having their paths to the big leagues blocked, presumably because many players who might otherwise have retired or would not have been successful in the big leagues without the illegal drugs were able to stay on.

This is probably a long shot of a lawsuit and legal scholars are divided on whether such a suit would have merit in a court of law. The claimant would have a pretty huge burden of proof to show that he was harmed. But the efficiency aspects of it are intriguing. If baseball players who used performance-enhancing drugs could be sued by minor leaguers claiming that their path to the big leagues was blocked by such cheats, this might be a more effective way to lead to the desired result, which, of course, is not to use the drugs. One successful suit for millions of dollars in damages might be enough to give correct incentives to all big league players to stay clean.