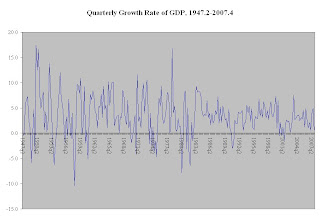

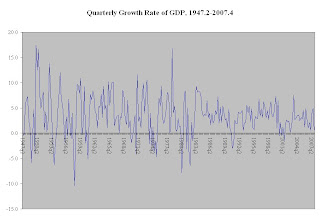

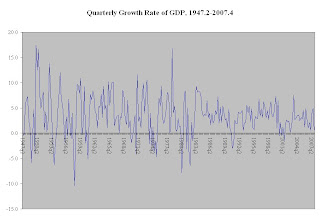

In the late 1970s the Federal Reserve, under Paul Volcker, effectively abandoned interest rate targets and instead began targeting the money supply. While Fed economists and policy-makers might sometimes advocate "fine-tuning" and discretionary policy, the proof is in the pudding as the volatility in GDP growth has declined considerably since the 1980s. Milton Friedman argued that the test of a good model is its ability to predict. On that basis, the so-called "interventionist" policies seem to have worked.

1 comment:

The Fed has not targeted any monetary aggregates for many years.

Post a Comment